|

|

RECENT POSTS

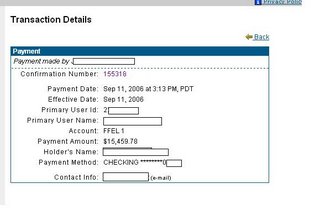

Friday, September 29, 20060 Comments Friday, September 22, 2006Enjoying the sunset... I will admit that I'm not the coolest finance blogger or been here the longest, or any title of the sort but man do I enjoy talking (and reading!) anything personal finance related. When it comes to the topic, you can call me mr. sponge. At the office, we were at the "water cooler" discussing home equity loans, coworkers juggling credit cards, and leasing new BMWs at the best rates. I just keep nodding, because no one really dives into anothers personal finances unless they WANT to talk about it. So I dont offer too many nuggest of advice, but on here, hey I'm as open as a church book on Sunday. Long story short, I like to clear my head by blogging and to ramble on about whats going on paycheck to paycheck. However, I dont know if I'm going to be writing as much now. My wife and I learned to set up a budget, reduce debt, and just live WAY WAY below our means. It gave us a chance to really focus and enjoy the simpler things. 2 years ago we use to go to clubs, dinners, movies, shopping at the mall, target, walmart, anywhere really... last weekend, we dug up the garden, planted flowers, enjoyed the sunset, and talked for hours playing stupid card games... who knows, maybe we ARE maturing... or maybe we're just old souls. On a side note, this weekend she is off to her cousin's wedding shower with her mom and I'm doing house chores, watching some football and playing poker with the guys. 0 Comments Tuesday, September 19, 2006Splurging on a little crap...A little splurging on crap never hurt anyone (from time to time). Interestingly enough we have found that we have fallen back a little into the financial trap. We have been paying for a few home improvement items as well as a little splurging our favorite money dumping ground, Target. Its been such a fun week :) Now we have to pay about $1000 BACK into our emergency fund. We both decided we needed a little break then its back to the grindstone of saving and frugality. Honestly, I kinda enjoy the highs and the lows a little. Sick thinking, I know.0 Comments Saturday, September 16, 2006Our first "check"This week we used our first "check" that we normally use to pay down our debt towards the first half of our fence payment. I pay 1/3 of the fence upfront and then 2/3 of the fence payment when its completed. The company we hired said it would be approx. a 5 week wait. Honestly, I dont mind because they did give me a great deal and worked with me. This weekend, I'm working in the backyard and the wife is planting some flowers in the bed in the front. FUN FUN! :)0 Comments Thursday, September 14, 2006Final Payment SENT for Student Loan! I've been working so hard, I havent been able to put up any postings. I love to blog so I wanted to note this fantastic moment of when we are debt free except for our mortgage! :) It took some time but here is what we've paid off since Jan. 2003: Car #1 $13,180.68 Car #2 $13,543.49 Capital One CC $2834.00 MBNA CC 1 $1061.72 MBNA CC 2 $6110.01 Student Loan 1 $6685.58 Student Loan 2 $18,340.18!!!!! I want to thank my beautiful wife who encourages me daily to be the best I can be! Time to save up for the baby and pay down the house! :) 4 Comments Wednesday, September 06, 2006Our Mortgage I'll admit I have a mortgage... a bad mortgage... an ARM mortgage. This 5/1 ARM was given at such a low interest rate that I couldn't get away from it. I know that I could have went with a 15 year or a 30 year fixed however I believe its all psychological. Lets say I decided to get a 15 year... more than likely I will pay it off in 15 years maybe throwing an extra payment here or there. With a 5 year ARM, even though it is amortized at 30 years, it gives me a psychological bearing that makes me pay it off in 5 years. Also I have a plan, which alot of these ARMers don't have. Plus my wife and I are really disciplined with our finances to pay it down in 5 years. I read so many posts, blogs, articles etc, on people that have the mentality that they will just refinance when the ARM comes due. Really this just sets you back to the 30 year process and starts the high interest payment cycle all over again. With that, the ARMs are probably only going to adjust upward with the way the housing market is going. I say if you take a 5 or 3 year ARM, either have a plan to pay it off in that time frame or refinance now to a fixed. Even though the thought of having a house paid off makes us a little giddy; it does take alot of patience, focus and a great automatic payment system on the 2nd of the month to get there. Back in business: My long term goal has changed from retiring and playing golf to owning a business. Whether that be a franchise, buying an existing business or doing a start up I'm considering all my options. We are searching deep within our interests and passions to find what we can bring to the table. Again just a baby stage thought. 0 Comments Saturday, September 02, 2006Which celebrity is making the most in 2006?I thought this was so interesting because as we go through out simple lives, these guys and gals are making millions to entertain us. Check out the 2006 top 100 money making celebrities here. Looking at the numbers, I might be in the wrong profession!!POWER ranking #1 for 2006 is Tom Cruise.... my wife wants to see pics of their little baby Suri. Honestly, I dont care but ok I'll get wrapped up the hype... JUST THIS ONCE :P 0 Comments |